Intuit accepts no responsibility for the accuracy, legality, or content on these sites. Marshall Hargrave is a financial writer with over 15 years of expertise spanning the finance and investing fields. He has experience as an editor for Investopedia and has worked with the likes of the Consumer Bankers Association and National Venture Capital Association. Marshall is a former Securities & Exchange sep ira with employees Commission-registered investment adviser and holds a Bachelor’s degree in finance from Appalachian State University. Current liabilities are any outstanding payments that are due within the year, while non-current or long-term liabilities are payments due more than a year from the date of the report. I have primarily audited governments, nonprofits, and small businesses for the last forty years.

How to set up the chart of accounts

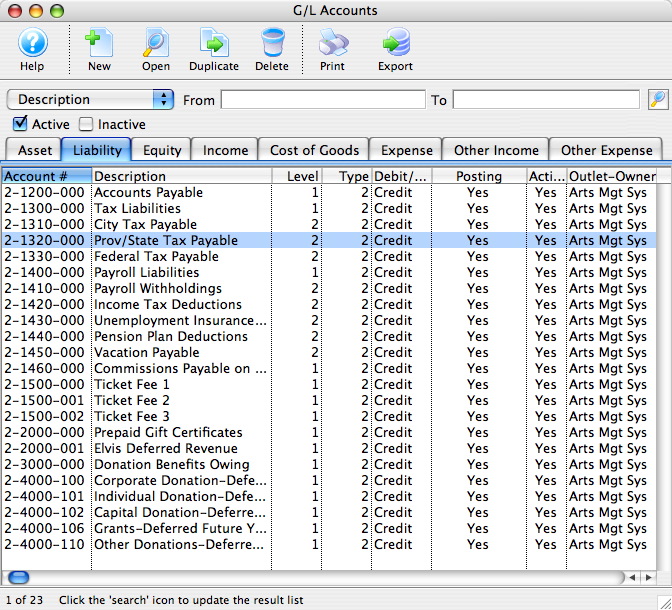

If you’re running a larger company, you’ll likely want to track your COGS by department or product line in your chart of accounts. A COA is a list of the account names a company uses to label transactions and keep tabs on its finances. You use a COA to organize transactions into groups, which in turn helps you track money coming in and out of the company. In summary, a well-designed Chart of Accounts is crucial to an organization’s financial success. By having a clear understanding of the COA’s purpose, structure, and organization, businesses can maintain accurate financial records and make informed decisions based on reliable data. Each category will include specific accounts for your business, like a business vehicle that you own would be recorded as an asset account.

Best Accounting Software for Small Businesses of 2024

It should be noted that the number of accounts expands rapidly when department and division codes are added to the account code. Care should be taken not to over complicate the chart of accounts numbering system otherwise the bookkeeping and decision making processes within the business may become swamped with too much detail. The Chart of Accounts is one of those unknown parts of your accounting software we don’t even think about. In this ultimate guide, not only do we explore examples of a common chart of accounts but also we discuss best practices on how to properly set up your chart of accounts. Accounts payable (AP) automation software plays a significant role in enhancing the management and optimization of a chart of accounts. It automates routine accounting tasks, reducing the likelihood of manual errors and saving time.

Departments and Divisions

These accounts are separated into different categories, including revenue, liabilities, assets, and expenditures. A chart of accounts has accounts from the balance sheet and income statement and feeds into both of these accounts. This numbering system helps bookkeepers and accountants keep track of accounts along with what category they belong two. For instance, if an account’s name or description is ambiguous, the bookkeeper can simply look at the prefix to know exactly what it is. An account might simply be named “insurance offset.” What does that mean? The bookkeeper would be able to tell the difference by the account number.

Which of these is most important for your financial advisor to have?

- Current liabilities are obligations due within one year or the company’s operating cycle, whichever is longer.

- A well-structured COA is essential for generating accurate financial reports, enabling the management to monitor financial performance and make informed decisions.

- Your long-term liabilities, which include debts like mortgages and bonds, are listed after your more current liabilities.

- Assigning numbers to accounts is a thoughtful process, designed to accommodate future expansions by reserving gaps for new accounts as the business grows or diversifies.

A well-designed COA plays a vital role in financial analysis, especially when it comes to forecasting and modeling. Implementing an organized COA supports the accurate analysis of financial data, which is crucial for sound decision-making and overall business performance. Retained earnings represent the accumulated net income that has not been distributed as dividends to the shareholders. These earnings are retained within the company to be reinvested in the business, finance expansions, or repay debt. Retained earnings can positively impact the company’s financial stability and growth prospects.

Noncurrent assets are tangible assets with a useful life of more than one year that are acquired for long-term use in the business. They are used to generate income over the long term and are less liquid than current assets, as they aren’t intended for quick conversion to cash. Fixed assets are also subject to depreciation, which reflects the decrease in their value over time due to wear and tear, obsolescence, or other factors. Current assets are expected to be converted into cash or used up within one year or the company’s operating cycle, whichever is longer. An asset is a resource that a company controls to run and grow its business. A standard COA will be a numbered list of the accounts that fill out a company’s general ledger, acting as a filing system that categorizes a company’s accounts.

Add an account statement column to your COA to record which statement you’ll be using for each account, like cash flow, balance sheet, or income statement. For example, balance sheets are typically used for asset and liability accounts, while income statements are used for expense accounts. Large and small companies use a COA to organize their finances and give interested parties, such as investors and shareholders, a clear view and understanding of their financial health. Separating expenditures, revenue, assets, and liabilities helps to achieve this and ensures that financial statements are in compliance with reporting standards. The chart of accounts is designed to be a map of your business and its various financial parts. A well-designed chart of accounts should separate all the company’s most important accounts and make it easy to determine which transactions should be recorded in which account.

To create a comprehensive and effective chart of accounts, it’s vital to understand its structure and the different types of accounts it includes. Breaking down the COA into categories such as assets, liabilities, equity, revenue, and expenses allows for easy organization and analysis of a company’s financial health. Additionally, integrating a COA into accounting software can further streamline financial management and reporting.