We’ll also explore how modern software solutions can optimize this process for businesses. The average payment period and the accounts receivable turnover ratio measure different things, but they relate to how a company manages its cash flow. The accounts receivable turnover ratio measures how quickly a company collects cash from its customers. While the average payment period focuses on outgoing cash to suppliers, the accounts receivable turnover ratio focuses on incoming cash from customers.

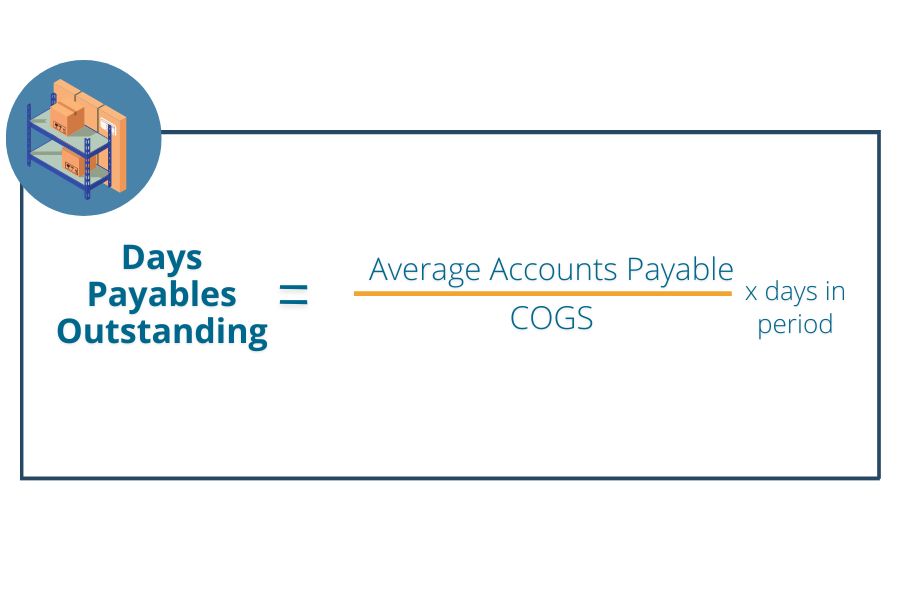

Divide this result into the average accounts payable

The Average Payment Period (APP) represents a financial metric used to evaluate the time it takes for a company to pay off its creditors. In essence, it signifies the average time a company needs to honor its short-term financial obligations to its suppliers or creditors. The APP provides valuable insights into a company’s financial health and cash management strategies. Accounts payable turnover is a ratio that measures the speed with which a company pays its suppliers.

Best Internal Source of Fund That Company Could Benefit From (Example and Explanation)

In this section, we explore how DPO benchmarks differ among sectors and what these variations indicate about a company’s cash management and supplier relationships. Beyond the formula, other considerations include excluding cash payments irs income tax audit to suppliers and including only credit purchases to ensure the AP days are high enough. In addition, AP automation simplifies the process by making pertinent financial data instantly available for analysis and processing.

What Is A Good Average Payment Period?

Assume for the purposes of this illustration that a manufacturing business regularly purchases some of the raw materials it needs for production on credit. The company is looking for a new supplier who wants to know the average payment period of the business in order to establish a credit plan. Not managing the accounts payable could lead to late payments and bad market reputation. Let’s take a look at the meaning and the method of calculating the average account payable.

Limitations of Average Payment Period

- Because you are looking for the yearly average you ask to see the previous years financial statements.

- While DPO measures how long it takes to pay suppliers, Days Sales Outstanding (DSO) measures how quickly your company collects payments from customers.

- Accounts payable turnover ratio is an accounting liquidity metric that evaluates how fast a company pays off its creditors (suppliers).

- The calculator allows you to calculate the average payable period for a period of your choice, you just have to edit the number of days to get the desired results.

For instance, if the business takes too long to pay the supplier, they might limit material supply during the season. However, if the DSO were to increase significantly, it could indicate that the retail business is facing delays in receiving payments, potentially leading to cashflow challenges. By optimizing this metric, you can extend the time to pay suppliers, freeing up cash for other critical needs. Another method of optimizing the APP involves negotiating extended credit terms with suppliers. A high DPO can indicate a company that is using capital resourcefully but it can also show that the company is struggling to pay its creditors. Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser.

As a rule of thumb, the average payment period is determined by utilizing a year’s worth information. Nevertheless, it could be really useful to do an evaluation on a quarterly basis, or over a specific timeframe. For instance, if the balance is paid by the due date specified by the supplier, a business may receive a 10% discount on its purchases from the supplier. Suppliers are more likely to provide special payment rates if the company’s APP demonstrates that it is capable of quickly paying off its credit balances and covering its immediate expenses. At the basic level, it only tells the average length of time it takes for a company to pay back its vendors.

However, an excessively high DPO might signal potential finances problems or strained supplier relationships. This ratio is crucial to understand how efficiently a company manages its cashflow and accounts payable process. Another essential component to understanding and improving your average payment period is the concept of Days Sales Outstanding or DSO. In addition, a higher DPO may mean several things and usually must be further investigated as the figure by itself doesn’t mean much. For example, a company may be thinking that its DPO means it is efficiently using capital. On the contrary, the company may actually be paying vendors late and racking up late fees.

On the other hand, a shorter payment period often signifies strong financial health and ethical practices. While this could offer the benefit of increased trust from suppliers, it could also lead to a high outflow of cash, which may not be favorable for companies who are trying to preserve cash. The calculator allows you to calculate the average payable period for a period of your choice, you just have to edit the number of days to get the desired results. A high average payment period may be bad for a company that is likely to lose customers if they are slow with paying their bills. If a company’s average payment period is shorter than that of its competitors, it signifies that the company has a higher capacity to repay debts compared to others. By computing it, you can assess the appropriateness of your payment terms, credit policies, and choice of business partners.