The $1,000 net profit balance generated through the accounting period then shifts. This is from the income summary to the retained earnings account. The closing journal entries example comprises of opening and closing balances. Opening entries include revenue, expense, Depreciation etc., while closing entries include closing balance of revenue, liability, Depreciation etc.

Financial Accounting

It’s necessary to properly assess depreciation for items like fixed assets and to amortize capitalized expenses as they each affect your balance sheet and taxable income. All modern accounting software automatically generates closing entries, so these entries are no longer required of the accountant; it is usually not even apparent that these entries are being made. The month-end close is when a business collects financial accounting information. Using the above steps, let’s go through an example of what the closing entry process may look like.

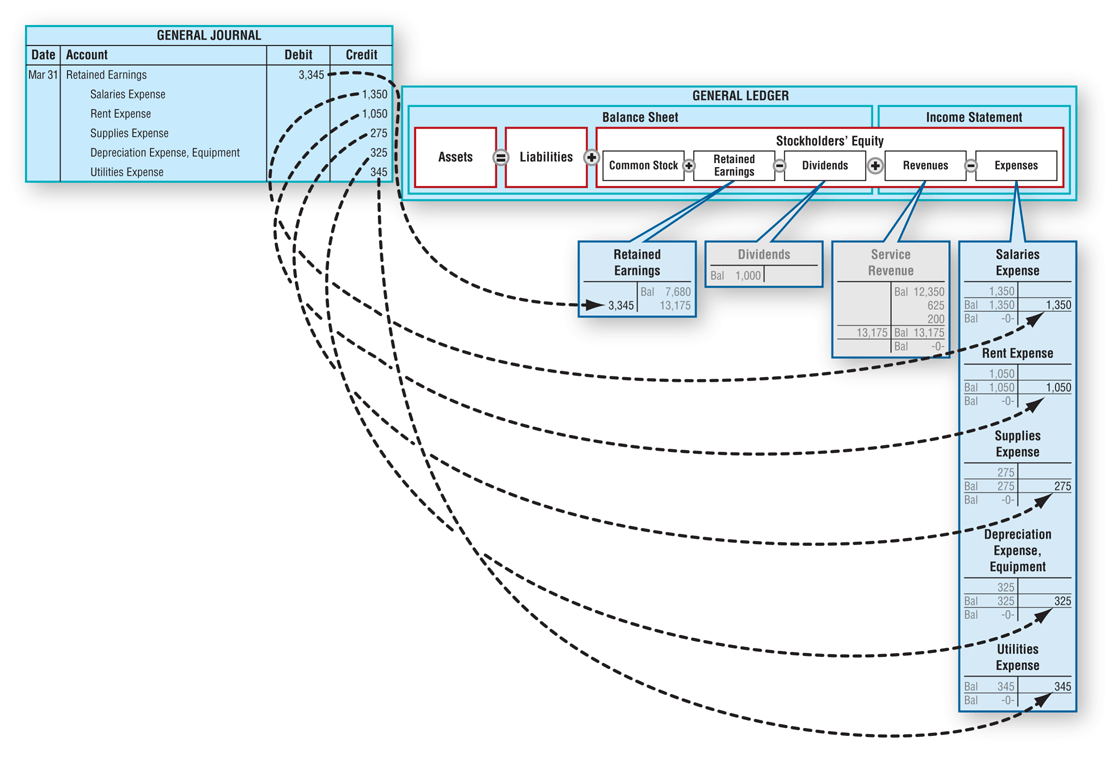

Closing Entry for Expense Account

We are going to go over these at a high level and then jump into each step individually. The T-account summary for Printing Plus after closing entriesare journalized is presented in Figure 5.7. Then, just pick the specific date and year you want the closing process to take place, and you’re done!

The Accounting Cycle

Income summary is a holding account used to aggregate all income accounts except for dividend expenses. It’s not reported on any financial statements because it’s only used during the closing process and the account balance is zero at the end of the closing process. The net income (NI) is moved into retained earnings on the balance sheet as part of the closing entry process.

Step 2: Close all expense accounts to Income Summary

- Closing entries are an important facet of keeping your business’s books and records in order.

- From the Deskera “Financial Year Closing” tab, you can easily choose the duration of your accounting closing period and the type of permanent account you’ll be closing your books to.

- The fourth entry requires Dividends to close to the RetainedEarnings account.

- These entries transfer balances from temporary accounts—such as revenues, expenses, and dividends—into permanent accounts like retained earnings.

To reference our early automotive analogy, while every car might run a little differently, they all perform best with proactive care and maintenance. In the same way, a good month end close requires teams to iron out processes, implement checklists, and leverage automation in order to get top-notch closing times. The most efficient accounting teams don’t try to cram every close task into the military tax tips close period. Instead, for things like payroll that can be accounted for in advance, they accomplish these tasks pre-close. Achieving the right level of detail and accuracy helps to identify issues, fix processes, and ultimately cut down on the time to close. However, teams must balance a desire for accuracy with a focus on prioritizing the data that’s required to inform business decisions.

How Long Does the Month End Close Take?

Lastly, prepare a post-closing trial balance to verify that the balances of the permanent accounts are correct and that the temporary accounts have been reset to zero. Closing entries are those journal entries made in a manual accounting system at the end of an accounting period to shift the balances in temporary accounts to permanent accounts. This is a necessary part of the closing process that occurs at the end of each reporting period.

All revenue accounts are first transferred to the income summary. Here you will focus on debiting all of your business’s revenue accounts. All the temporary accounts, including revenue, expense, and dividends, have now been reset to zero. The balances from these temporary accounts have been transferred to the permanent account, retained earnings.

You can report retained earnings either on your balance sheet or income statement. Without transferring funds, your financial statements will be inaccurate. These permanent accounts form the foundation of your business’s balance sheet. However, you might wonder, where are the revenue, expense, and dividend accounts? These accounts were reset to zero at the end of the previous year to start afresh.

All expense accounts are then closed to the income summary account by crediting the expense accounts and debiting income summary. If your revenues are greater than your expenses, you will debit your income summary account and credit your retained earnings account. ‘Total expenses‘ account is credited to record the closing entry for expense accounts. If dividends were not declared, closing entries would cease atthis point.

Essentially resetting the account balances to zero on the general ledger. Closing entries are performed after adjusting entries in the accounting cycle. Adjusting entries ensures that revenues and expenses are appropriately recognized in the correct accounting period. Once adjusting entries have been made, closing entries are used to reset temporary accounts. One account you’ll want to be aware of when performing closing entries is the income summary account. The income summary account is a temporary account that you put all revenue and expense accounts into at the end of the accounting period.